Loading

Altegris Futures Evolution Strategy Fund -

Quarterly Fact Sheet

Quarterly Commentary

Quarterly Presentation

Investment Approach

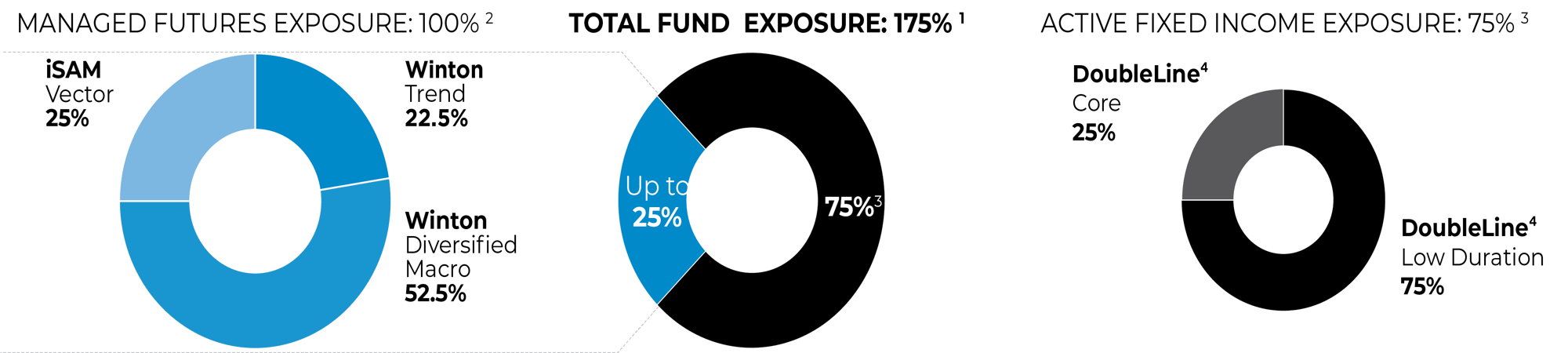

The Fund seeks to achieve long-term capital appreciation. An evolutionary approach to managed futures which combines a focus on trend following with active fixed income management.

Managed Futures Strategy

Designed to achieve capital appreciation in the financial and commodities futures markets. The Fund may allocate up to 25% to securities that access managed futures, and attempt to maintain exposure to managed futures strategies as if between 100%-125% of the Fund’s net assets were invested in managed futures strategies.

Fixed Income Strategy

Designed to generate interest income and capital appreciation through various sub-strategies including “core fixed income”, “low duration”, and “opportunistic income”.

We believe the key differentiator of the Altegris Futures Evolution Strategy Fund is the fixed income allocation. Assets of the Fund not directed by the adviser to investments in managed futures investments will be allocated to investments in fixed income strategies by the sub-adviser, DoubleLine Capital LP. This active fixed income approach has the ability to invest in securities of varying quality or maturity.

Investing involves risk, including loss of principal. There is no guarantee that the investing strategy will achieve it’s goals. Derivatives Risk: Futures, options and swaps involve risks different from, or possibly greater than the risks associated with investing directly in securities including leverage risk, tracking risk and counterparty default risk in the case of over the counter derivatives. Option positions may expire worthless exposing the Fund to potentially significant losses. Fixed Income Risk: When a fund invest in fixed income securities or derivatives, the value of your investment in the fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities or derivatives owned by a fund.

Performance

Inception date of Class A and I is October 31, 2011; Class C is February 16, 2012.

The maximum sales charge (load) for Class A is 5.75%. Class A Share investors may be eligible for a reduction in sales charges. The total annual fund operating expense ratio is 1.59%, 2.34%, and 1.34% of average daily net assets attributable to Class A, C, and I respectively. The Adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund as described in the Fund Summary, until at least October 31, 2024. This agreement may only be terminated only by the Board of Trustees, on 60 days written notice to the Adviser. See Fund’s Prospectus for details.

The performance data quoted here represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Results shown reflect the waiver, without which the results would have been lower. A Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. For performance information current to the most recent month end, please call (888) 524-9441.

Fund Expense Ratio does not include management fees and incentive fees associated with managed futures investments. These costs are included in the investment return of such managed futures investments.

There are significant differences in the risk and volatility of the Fund relative to an index. An index is unmanaged and not available for direct investment.

Past performance is not indicative of future results. Performance represents cumulative returns over specified time period. Fund inception is 10/31/11. Fund return shown above is based on Class A shares at NAV and assumes reinvestment of income. It does not take into account sales charges or the effect of taxes which would reduce return. The principal value and return of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance, especially for short periods of time, should not be the sole factor in making an investment decision. There is no guarantee that any investment will achieve its objective, generate profits or avoid losses.

There are significant differences in the risk and volatility of the Fund relative to an index. An index is unmanaged and not available for direct investment.

Past performance is not indicative of future results. Performance represents cumulative returns over specified time period. Fund inception is 10/31/11. Fund return shown above is based on Class A shares at NAV and assumes reinvestment of income. It does not take into account sales charges or the effect of taxes which would reduce return. The principal value and return of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance, especially for short periods of time, should not be the sole factor in making an investment decision. There is no guarantee that any investment will achieve its objective, generate profits or avoid losses.

There are significant differences in the risk and volatility of the Fund relative to an index. An index is unmanaged and not available for direct investment.

Past performance is not indicative of future results. Performance represents cumulative returns over specified time period. Fund inception is 10/31/11. Fund return shown above is based on Class A shares at NAV and assumes reinvestment of income. It does not take into account sales charges or the effect of taxes which would reduce return. The principal value and return of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance, especially for short periods of time, should not be the sole factor in making an investment decision. There is no guarantee that any investment will achieve its objective, generate profits or avoid losses.

There are significant differences in the risk and volatility of the Fund relative to an index. An index is unmanaged and not available for direct investment.

Key Facts

Target Fund Exposure

As of most recent prospectus

1 Total exposure of the Fund will range from 170% to no more than 200%. Altegris is not affiliated with the managers. 2 The managed futures investments selected by Altegris Advisors to gain exposure to the managed futures managers listed above are subject to change at any time, and any such change may alter the strategy’s access and percentage exposures to each such manager. The strategy currently pursues its managed futures strategy through an option facility which accesses these managers, who are not direct sub-advisers to the Fund. The strategy may also make managed futures investments directly. Typical managed futures strategy exposure will be 100% up to a maximum of 125% using notional funding. Notional funding is the term used for funding an account below its nominal value. It is a form of leverage that does not involve borrowing. Leverage can increase the volatility of the investment. 3 Typically, 60%–80% of the Fund’s total net assets will be invested in fixed income strategies. 4 The Fund currently pursues its fixed income strategy through investment in mutual fund(s) actively managed by DoubleLine Capital LP.

Managed Futures Exposure

Portfolio Statistics

Past performance is not indicative of future results. Holdings and exposures are subject to change and should not be considered investment advice.

Top Holdings: Futures Asset Class Transparency

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Segment Breakdowns

Past performance is not indicative of future results. Portfolio holdings and exposures are subject to change and should not be considered investment advice. The fund also holds cash and equivalents which are excluded from the allocation of net assets shown.

Negative weightings may result from specific circumstances (including timing differences between trade and settle dates of securities purchased by the funds) and/or the use of certain financial instruments, including derivatives, which may be used to gain or reduce market exposure and/or risk management.

Fixed income exposure

Fund Strategy Statistics

Effective 7/1/21, the Fund pursues its Fixed Income strategy by investing in one or more Mutual Funds managed by DoubleLine Capital, LP (“DoubleLine”). Prior to 7/1/21, DoubleLine served as the Fund’s sub-adviser since the Fund’s inception. Allocations to DoubleLine Funds, including those not noted above may vary depending on the Adviser’s market assessments and allocation(s) may range as follows: Low Duration and/or Core Fixed Income: 70% - 100%; Opportunistic Fixed Income: 0% – 30% of the Fund’s overall Fixed Income strategy.

Fund Strategy Composition

Source: DoubleLine Low Duration mutual fund fact sheet as of date stated above.

Source: DoubleLine Low Duration mutual fund fact sheet as of date stated above.

Source: DoubleLine Low Duration mutual fund fact sheet as of date stated above.

Totals may not equal 100% due to rounding.

Fees and Expense Ratios

The Fund’s adviser has contractually agreed to reduce fees and reimburse expenses until at least October 31, 2024 terminable upon 60 days’ notice, so that total annual Fund Operating Expenses after waiver will not exceed 1.59%, 2.34%, and 1.34% of average daily net assets attributable to Class A, C, and I respectively.

Net Expenses do not include costs associated with over the-counter derivatives that provide the Fund with exposure to managed futures strategies via Underlying Pools, or the costs associated with the Underlying Pools themselves. All costs associated with such derivatives, including structuring and financing fees paid to the Fund’s counterparty, as well as the operating expenses, management fees and incentive fees of the associated Underlying Pools, are included in the investment return of these over-the-counter derivatives and represent an indirect cost of investing in the Fund. Further, incentive/performance fees cannot be meaningfully estimated but generally range from 15% to 25% of the trading profits of an Underlying Pool. The performance of the Fund is net of all such embedded incentive/performance fees. See Prospectus for details.

Distribution information is provided for the prior five calendar years. For distributions since inception, please request by emailing info@altegris.com.

Fund distributions will vary depending upon market conditions and number of shares outstanding. All dates and distributions are subject to board approval. Past distributions are no guarantee of future distributions or performance results.

Performance quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than performance data shown. Investment return and principal will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month end, please call (888) 524-9441.

This information is not intended to cover the complexities of a shareholder’s individual tax situation. Because tax laws vary among states, you should consult your tax advisor about the specific rules in the state(s) in which you pay income taxes.

Managers

Biography

Matt Osborne is the Chief Executive Officer (CEO), Chief Investment Officer (CIO) of Altegris, a provider of premier alternative investment solutions, where he oversees the firm's investment research, product structuring, and portfolio strategy team.

Prior to founding Altegris in 2002, Osborne was the director of research for the managed investments division of Man Financial, with responsibility for manager selection and research. Previously, Matt had a 12-year career with a prominent family investment office in his native New Zealand. In his role as senior investment manager, Osborne was responsible for formulating investment policies and implementing a global asset allocation program that focused on alternative investments, including hedge funds, managed futures, private equity, and real assets.

Osborne has significant trading expertise in equities, fixed income, foreign currencies, global futures, and options, among other securities. Matt currently holds FINRA Series 3, 7, 24, and 63 licenses.

Firm Overview

Altegris

Based in La Jolla, CA, Altegris was founded in 2002 and has continued to focus solely on alternative asset managers and strategies, because a sophisticated investment portfolio should not rely on stocks and bonds alone. Altegris builds actively managed investment solutions designed to help advisors, institutions and individual investors achieve greater alpha, lower their risk, and improve portfolio diversification. Altegris provides investors with access to innovative investment strategies through our proprietary research, sourcing, and structuring.

.png)

Biography

Firm Overview

Winton Capital Management

Founded in 1997 by CEO David Harding, Winton today has $10.2 billion in AUM as of 6/30/23 and manages assets for some of the largest institutional investors in the world. Headquartered in London, Winton is considered one of the pioneers of trend-following systematic trading in Europe. The quantitative trading strategies employed by Winton were initially based on exploiting the weak tendency of futures markets to exhibit trends. The success of these strategies enabled the firm to expand its research and technology teams and embark on a wide variety of further research projects. Staffed by scientists and computer software engineers it uses financial mathematics as the basis for investment decisions.

Winton’s founding principle was, and remains, the belief that robust statistical research provides the richest and most reliable source of information on market behavior. Staffed by scientists and computer software engineers, it uses financial mathematics as the basis for investment decisions. Researchers study huge volumes of data, about the past movements of financial prices taken from markets around the world. Making statistical inferences from history has enabled Winton to develop a scientific investing system which can be applied in a disciplined fashion both now and over the coming years. Research is the largest area of investment in the company. Learn more at https://www.winton.com/overview.

.png)

Biography

Jeffrey Gundlach, CEO & CIO

Mr. Gundlach is CEO of DoubleLine. In 2011, he appeared on the cover of Barron's as "The New Bond King." In 2013, Institutional Investor named him "Money Manager of the Year." In 2012, 2015, and 2016, he was named one of "The Fifty Most Influential" in Bloomberg Markets. In 2017, he was inducted into the FIASI Fixed Income Hall of Fame. Mr. Gundlach is a summa cum laude graduate of Dartmouth College, with degrees in Mathematics and Philosophy.

Jeffrey J. Sherman, CFA, Deputy Chief Investment Officer

As DoubleLine’s Deputy Chief Investment Officer, Jeffrey Sherman oversees and administers DoubleLine’s Investment Management sub-committee coordinating and implementing policies and processes across the investment teams. He also serves as lead portfolio manager for multi-sector and derivative-based strategies. He is a member of DoubleLine’s Executive Management and Fixed Income Asset Allocation Committees. He can be heard regularly on his podcast “The Sherman Show” (@ShermanShowPod), where he interviews distinguished guests, giving listeners insight into DoubleLine’s current views. In 2018, Money Management Executive named Jeffrey Sherman one of “10 Fund Managers to Watch” in its yearly special report. Before joining DoubleLine in 2009, he was a Senior Vice President at TCW, where he worked as a portfolio manager and quantitative analyst focused on fixed income and real-asset portfolios. Mr. Sherman was a statistics and mathematics instructor at both the University of the Pacific and Florida State University. He taught Quantitative Methods for Level I candidates in the CFA LA/USC Review Program for many years. He holds a BS in Applied Mathematics from the University of the Pacific and an MS in Financial Engineering from the Claremont Graduate University. He is a CFA® charterholder.

Firm Overview

DoubleLine Capital

DoubleLine Capital was previously the sub-adviser to EVOIX, managing the fixed-income portion of the Fund since Fund inception in 2011 until July 2021 when the Fund re-structured to access DoubleLine’s fixed income management through their mutual fund offerings.

Headquartered in L.A. and founded in 2009, DoubleLine is an independent, employee-owned money management firm that seeks to deliver better risk-adjusted fixed income returns with over $96 billion in combined assets under management as of 6/30/23 across a wide array of investment strategies. The firm’s experienced team of portfolio managers have worked together on average 15 years. DoubleLine’s investment strategies include U.S. Fixed Income, Global Fixed Income, Emerging Markets Fixed Income, U.S. Equity, Commodities, and Global Multi-Asset products. To learn more, please visit https://doubleline.com/firm-overview/ or https://doubleline.com/wp-content/uploads/DoubleLine-Company-Summary.pdf

Biography

Roy Sher, Managing Director

Roy Sher is, along with Alex Lowe, responsible for the day-to-day running of iSAM. He is a member of the iSAM Vector Investment Committee, the iSAM Compliance and Risk Committee, the iSAM Securities Trading Committee, and the iSAM Helix Investment Committee. Roy began his career at SBC Warburg in London and was posted to Hong Kong in 1996. While there, he moved to Merrill Lynch, where he was head of Convertible Bond Trading and Asset Swap Trading, and later a senior proprietary trader. He returned to London with Merrill Lynch in 2000 and was instrumental in establishing the proprietary trading operations in the equities division there. He joined GLG Partners in 2002 and, a year later, established International Standard Fund, which became International Standard Asset Management (iSAM). Roy has traded across many products, including equity and bond options, convertible bonds and asset swaps, index arbitrage, equities, and debt.

Roy graduated from the University of Cape Town with a degree in Accounting and Economics and a Post Graduate Diploma in Accounting and Finance.

Alexander Lowe, Managing Director

Alex Lowe is, along with Roy Sher, responsible for the day-to-day running of iSAM. He is a member of the iSAM Vector Investment Committee, the iSAM Compliance and Risk Committee, the iSAM Securities Trading Committee, and the iSAM Helix Investment Committee. Alex was previously at Man Group, where he was CEO of Man Global Strategies (MGS) and a Director of Man Investments Limited. MGS was a division of Man Group, running over 100 products investing $19bn of client money into a wide range of hedge fund strategies across the globe. In addition, MGS was responsible for a pool of $500m of Man Group’s proprietary capital for investments into early-stage managers making approximately six to ten such investments a year. Before Man, Alex worked as a Senior Trader at BNP Paribas in Paris from 2001 - 2003, where he was responsible for Equity Relative Value Trading, setting up a series of quantitative models trading in Europe, the US, and Asia, and at ING Barings from 1998 - 2001 as a senior salesman.Alex graduated from the University of Newcastle with a degree in Politics and was a Captain in the British Army.

Firm Overview

iSAM

Formed in 2008, International Standard Asset Management (iSAM) is an Alternative Investment Adviser headquartered in London with significant experience in the quantitative alternative investment space. iSAM Vector is a specialist quantitative strategy trading a diverse set of global financial and commodity markets in a highly disciplined and systematic framework. The program seeks profits from persistent price movements on time frames ranging from intraday to several months and employs a dynamic portfolio construction framework aiming to deliver diversifying absolute returns that have low correlation to traditional asset classes and attractive skew. The strategy is applied to over 550 global markets in an integrated portfolio, with a strong emphasis on alternative markets, diversifying commodity exposures and allocations to short-term trading engines. iSAM aims to limit the capacity of the strategy to ensure the ongoing delivery of maximum diversification. As of June 30, 2023, iSAM manages US $5 billion and has 150 employees worldwide with offices in Grand Cayman, London, Florida, Hong Kong, and Michigan. To learn more, please visit https://www.isamfunds.com/

Ratings and Awards

Morningstar Rating™

HFM Best ‘40-Act Equity Fund

Winner

US Hedge Fund Performance Awards 2016

Documents

Legal and Compliance

You Might Also Like

Quarterly Fact Sheet

A quick stat sheet on performance, contribution, manager updates, and key fund facts.

ViewQuarterly Commentary

A quarterly commentary are everchanging market conditions impacting the fund and sector alike.

Read MoreManaged Futures and Inflation White Paper

What If Inflation Isn't Transitory? A five-minute bulletin on potential inflation hedging in the Managed Futures sector.

Read MoreSystematic Trend Strategy Deck

Learn more about the potential crisis-risk offset and non-correlation benefits of Systematic Trend. Read MoreCAREFULLY CONSIDER THE FUND'S INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES AS DETAILED IN ITS PROSPECTUS AND SUMMARY PROSPECTUS, WHICH CAN BE OBTAINED BY CALLING (888) 524-9441. READ THE PROSPECTUS CAREFULLY BEFORE INVESTING.

Funds are distributed by Northern Lights Distributors, LLC. Altegris Advisors and Northern Lights Distributors, LLC are not affiliated.

Important Risk Disclosures

THE FUND MAY NOT BE SUITABLE FOR ALL INVESTORS

Investing involves risk, including possible loss of principal. You may have a gain or loss when you sell shares. There can be no assurance that the Fund will achieve its investment objectives. The Fund’s investments in commodity futures markets are volatile, as commodity futures prices are influenced by unfavorable weather, geologic and environmental factors, regulatory changes and restrictions. Trading and investing on non-US exchanges and in non-US markets poses additional risks as compared to trading and investing in the U.S., due to currency fluctuation, adverse political or economic conditions, and differing audit and legal standards (risks that are magnified for investments in emerging markets). The Fund will invest in futures, swaps, structured notes, options and other derivative instruments, which are leveraged and can be more volatile. less liquid, and subject to the Fund to increased costs, as compared to traditional investments. Derivatives may also be subject to increased tracking risk, risk of counterparty default, adverse tax treatment. The Fund will leverage investments to the extent permitted by its investment policies and applicable law, and the managed futures programs it accesses will be traded with additional notional funding – all of which will magnify the impact of increases or decreases in the value of Fund investments and cause the Fund to incur additional expenses. Futures contracts are generally liquid, but under certain market conditions there may not always be a liquid secondary market. The Fund’s use of short selling and taking short positions in derivatives involves increased risks and costs, as the Fund may pay more for an investment than it receives in a short sale, with potentially significant and possibly unlimited losses. The Fund’s investment in other investment funds will subject it to the risks and expenses affecting those funds. The Fund invests in fixed income securities, including preferred stock, and their values typically fall when interest rates rise. Fixed income securities are subject to the issuer’s credit risk, risk of default and prepayment risk in the case of mortgage-backed and similar securities. Below investment grade and lower quality high yield or junk bonds present heightened credit risk, liquidity risk, and potential for default. Investing in defaulted or distressed securities is considered speculative. REITs are subject to market, sector and interest rate risk.

ALTEGRIS ADVISORS

Altegris Advisors, LLC is a CFTC- and NFA-registered commodity pool operator and SEC-registered investment adviser that manages funds pursuing alternative investment strategies.

INDEX DESCRIPTIONS

An index is unmanaged, not available for direct investment, and its performance does not reflect transaction costs, fees, or expenses.

BofA Merrill Lynch 3-month T-Bill Index: The BofA Merrill Lynch 3-month T-Bill Index measures the returns of three-month Treasury Bills.

GLOSSARY

Short. Selling an asset/security that may have been borrowed from a third party with the intention of subsequently buying it back. Short positions profit from a decline in price. If a short position increases in price, the potential loss of an uncovered short is unlimited.

Long. Buying an asset/security that gives partial ownership to the buyer of the position. Long positions profit from an increase in price.

Value at Risk (VAR). A measure of the potential loss in value of a portfolio over a defined period for a given confidence interval. A one-day VAR at the 95% confidence level represents that there is a 5% probability that the mark-to-market loss on the portfolio over a one day horizon will exceed this value (assuming normal markets and no trading in the portfolio).

High yield. income securities with a belowinvestment grade credit rating; also known as “junk” bonds. Because of a higher risk of default, they typically pay a higher rate of interest or income.

Investment grade. A credit rating that is in one of the top categories by Standard & Poor’s (BBB- or higher) or Moody’s (Baa3 or higher). Typically believed to have adequate to exceptional ability to pay interest and repay principal.

Agency. Debt securities issued by U.S. government-sponsored entities such as Federal National Mortgage Association or the Federal Home Loan Bank.

4129-NLD-10272023

Policies + Forms

PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE THAT ANY INVESTMENT WILL ACHIEVE ITS OBJECTIVES, GENERATE PROFITS OR AVOID LOSSES.

Alternative investments are complex and can involve a high degree of risk. They may not be suitable for everyone as they can be illiquid, highly leveraged, speculative, non-diversified, volatile and/or subject to potentially substantial loss. Alternative investments may also lack transparency, trade in non-U.S. markets, and have tax structures resulting in delayed tax reporting. Alternative investments offered privately, as compared to mutual funds, are subject to less regulation and may charge higher fees, while mutual funds, though more regulated, still involve risks including possible loss of principal.

Investment advisory services provided by Altegris Advisors, LLC, a registered investment adviser and commodity pool operator. Securities may be offered through a 3rd party marketing partner Destra Capital Investments, LLC, a non-affiliated registered broker-dealer, and member of FINRA and SIPC. Such registrations and memberships in no way imply a regulator’s endorsement, nor any level of skill or training. The information on this site is not intended, nor should it be construed as, investment, tax, or legal advice, or a recommendation, offer or solicitation of an investment. Such information is subject to change, incomplete and represents Altegris’ opinions and beliefs which are believed to be from reliable sources, but their accuracy cannot be guaranteed and should not be relied upon when making investment decisions.